Syndicated loan

A loan that is provided by a group of lending institutions to a debtor is known as a syndicated loan, the group of institutions agree to provide a level of funds and in doing so the group is called a syndicate. Among the group of lenders will be a "head" or "principle underwriter" who is in charge of negotiating with the debtor and setting the terms of the agreement.[1]

Forming a syndicate allows the various institutions to reduce the risk in their loan and as each lender has to contribute fewer funds than if they were funding the loan them selves, because there is less money loaned out, the overall risk posed to the individual lender by the loan is also lower.[2] Each member of a syndicate contributes capital to the loan and makes profit accordingly, but also shares in the losses equally. Additionally, if a member of the syndicate fails to fulfill the requirements form the individual lender perspective, the other members of the syndicate must fulfill their obligation to the loan.[3] Construction of new power plants and large resource extraction projects (like drilling for oil) can be so expensive that syndicated loans are needed to finance the operation.

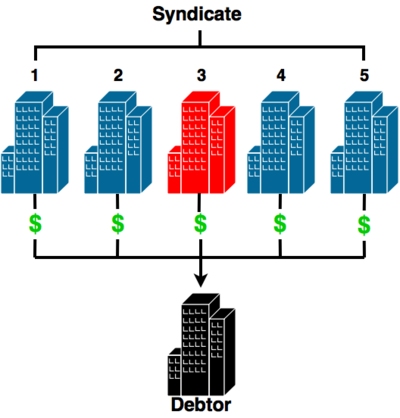

Syndicate Loan Structure

- The syndicate is formed by the lending institutions (banks), 1,2,3,4,5.

- Bank #3 (red) is the principle underwriter of the loan and contracts on behalf of the syndicate with the debtor.

- Each bank, including the principle underwriter contributes funds to the loan.

- If one bank (#5) is unable to contribute the amount they agreed to then the rest of the syndicate (1,2,3,4) must increase their funding to meet the terms of the agreement with the debtor.

This is a very simple loan scenario. Not all institutions loan the same amount, they tend to lend an amount proportional to their size. A larger bank will be able to contribute a larger proportion of funds and a smaller bank will contribute less. In this case, the share of profit and liability is determined based on the amount of funds contributed. If in the scenario above Bank #1 contributes 30% and bank #4 contributes 10% then their share of the profit will be 30% and 10% respectively.

The principle underwriter may, in some cases, take a larger share of profit where they have incurred legal, transaction or administrative costs from organizing the loan.[5]

References

- ↑ J. Berk et al. Corporate Finance. Toronto: Pearson Canada Inc., 2012, pp. 852.

- ↑ R. A. Brealey et al. Fundamentals of Corporate Finance. Toronto: McGraw-Hill Ryerson, 2012, pp. 656.

- ↑ 'A Dictionary of Economics', published by Oxford University Press. "Syndicate (at Lloyd's)." [Online], Available: http://www.oxfordreference.com/view/10.1093/acref/9780199237043.001.0001/acref-9780199237043-e-3048?rskey=XLCJQY&result=1 [Aug 21, 2016].

- ↑ Created internally by a member of the Energy Education team

- ↑ "A Dictionary of Economics", entry: Syndicated loan, published Oxford University Press, 2013. Edited by John Black, Nigar Hashimzade, and Gareth Myles Online version accessed [August 17th, 2017].