Carbon tax

A carbon tax is a tax levied on the carbon content in fossil fuels. Even though the tax is designed to address the problem caused by the CO2 emissions, the tax is based on the carbon content because almost all of the carbon is converted into CO2 from the combustion process.[1] A carbon tax is designed to have the price of a fuel reflect the true cost. The tax tries to takes into account any environmental consequences of using the fuel. In economic terms, a carbon tax tries to internalize the externality created by carbon emissions and is an attempt to change the behaviour that creates the externality. A carbon tax is a type of pigovian tax.

A carbon tax is different from an emissions trading (carbon cap and trade) system in that it sets the price on carbon dioxide emissions, rather than limiting the amount of carbon dioxide released.[2]

Double Dividend

A carbon tax raises the price per unit of fossil fuel which decreases the demand for the good. In addition to modifying behaviour which has harmful effects, the carbon tax also raises revenues that can be used to promote a low or no carbon energy alternatives or to fix the damage already caused to the environment. Additionally, the revenues raised from a carbon tax would allow a government to cut other forms of taxes which can distort a market and make it less efficient.[3]

So by instituting a carbon tax:

- Overall emissions are reduced.

- Extra tax revenue is raised

- Other taxes could be reduced or eliminated

- An externality is internalized (prices reflect the true cost of releasing carbon dioxide)

- Other markets could be made more efficient.

These extra benefits are referred to as the double-dividend, sort of like saving two birds with one tax.

In British Columbia (B.C) for the fiscal year 2013-2014 under the Carbon Tax Act the province raised $1.2 billion and at the same time was able to reduce corporate income taxes by $440 million, personal income tax by $237 million and were able to offer $194 million worth of low-income tax credits.[4] From 2008-2013, the institution of the carbon tax in B.C decreased per capita use of fossil fuels in the province by 16.1%.[5]

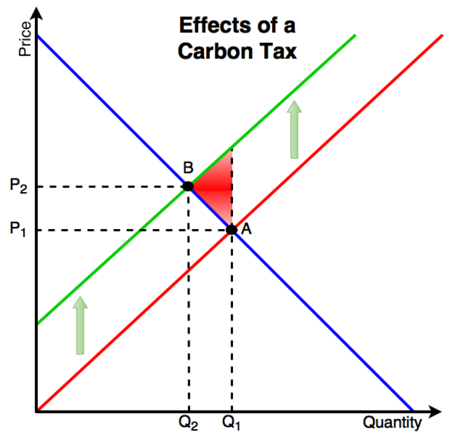

Effect of a Carbon Tax

- At Point A the market is efficient, the supply meets demand.

- The market is not socially efficient however as the carbon emissions produce adverse environmental effects.

- To compensate for the negative effects of an externality, a tax is imposed, raising the price from P1 to P2.

- The implementation of the tax and the subsequent rise in the price to the consumer reduces the quantity demanded from Q1 to Q2.

- The tax reduces the demand for fossil fuels, reducing the overall emissions and the revenue generated can be used to remediate environmental damage or invest in cleaner generation technologies.

- At Point B the market is socially efficient as the external costs of pollution that were not addressed before have been internalized using the tax. This eliminates the deadweight loss (DWT) in the market indicated by the red triangle.

An obstacle must be overcome when deciding the proper amount of tax to apply to an activity. Before a government issues a tax, it must determine the level of external cost (how much damage it does) it imposes. It is easier to asses some costs than it is others. For example, the cost of performing a lung replacement for a long time smoker is relatively similar across healthcare systems whereas assessing the true cost of pollution in an environment can be very difficult.[7] The problem of incomplete information means that the true size of a tax cannot be determined.[8] This creates a lag on the legislation of a carbon tax which delays the process of mitigation and remediation of damage caused by pollution.

See Also

- Negative externality

- Pollution

- Emissions trading

- Carbon dioxide

- Tax

- Pigovian tax

- Carbon tax vs emissions trading

References

- ↑ Verbruggen, A., W. Moomaw, J. Nyboer, 2011: Annex I: Glossary, Acronyms, Chemical Symbols and Prefixes. In IPCC Special Report on Renewable Energy Sources and Climate Change Mitigation [O. Edenhofer, R. Pichs- Madruga, Y. Sokona, K. Seyboth, P. Matschoss, S. Kadner, T. Zwickel, P. Eickemeier, G. Hansen, S. Schlömer, C. von Stechow (eds)], Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA.

- ↑ Private communication between Prof. Andrew Leach and Jason Donev in November of 2014.

- ↑ J.Black, N. Hashimzade, and G. Myles. (2009) "Double-Dividend Hypothesis." [Online], Available: http://www.oxfordreference.com/view/10.1093/acref/9780199237043.001.0001/acref-9780199237043-e-3570?rskey=16sqTu&result=2, 2009 [Aug 20, 2016]

- ↑ Pembina Institute. The B.C Carbon Tax Calgary: Pembina Institute for Appropriate Development, 2014, pp. 1.

- ↑ Pembina Institute. The B.C Carbon Tax. pp. 2.

- ↑ Created internally by a member of the Energy Education team

- ↑ Investopedia. "http://www.investopedia.com/terms/p/pigoviantax.asp?ad=dirN&qo=investopediaSiteSearch&qsrc=0&o=40186." [Online], Available: [Aug 13, 2016].

- ↑ R.S. Pindyck. "Pricing Carbon When We Don't Know The Right Price." Regulation, Summer 2013, pp. 2-3, 2013.