Subsidy

A subsidy is a payment or tax abatement form the government to the buyer or seller of a good or service to encourage either its sale or purchase.[1] A subsidy is essentially the opposite of a tax, whereas a tax raises the price of a good or service, a subsidy lowers it. Subsidies are a form of fiscal incentive and are often discussed as a fiscal policy tool that governments can use to fight climate change.

Assume a government wants to reduce the dependence of their country on fossil fuel, to encourage this, the government might give a subsidy to producers of solar panels as their use reduces the amount of electricity households draw from the grid that is powered by coal.[2] If the government offers a 20% subsidy on the production of solar systems and the cost of producing a system of panels that can power the house is $20,000 then the production cost will be $16,000. In short, a subsidy lowers the price in order to increase supply.

Effect of a Subsidy

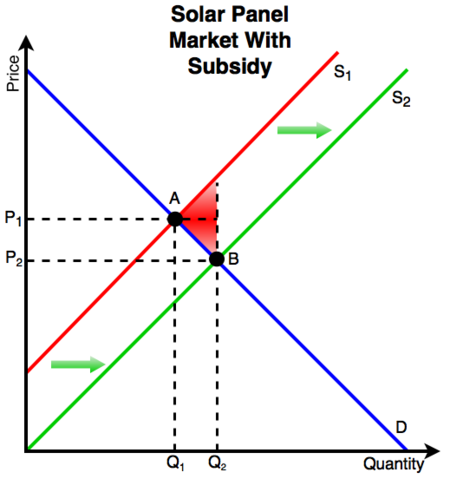

This is the example above shown graphically:

- At Point A the market is in equilibrium, the price (P1) is equal to the quantity supplied (Q1).

- When the subsidy is introduced the price paid by the consumer will drop from P1 to P2 but the seller of the panels will still receive P1 because the government pays the difference between P1 and P2.

- The lower price stimulates an increased supply of panels as the subsidy lowers the cost of production.[4]

- The red triangle indicates the deadweight loss or inefficiency resulting from the subsidy as the cost of the subsidy decreases the overall surplus to both the consumer and producer.

Another form of a subsidy is a tax incentive whereby governments offer a lower tax rate or a tax free period of time to encourage people or firms to act in a certain way.[5] For example, a city might offer a reduced property tax rate for homeowners who install solar panels or plant more trees on their property.

World wide, subsidies for renewable energy sources are on the rise, signaling a shift towards socially efficient electrical production methods.[6]

See Also

References

- ↑ A. Goolsbee, S. Levitt and C. Syverson. Microeconomics. New York: Worth Publishers, 2013, pp. 100.

- ↑ Verbruggen, A., W. Moomaw, J. Nyboer, 2011: Annex I: Glossary, Acronyms, Chemical Symbols and Prefixes. In IPCC Special Report on Renewable Energy Sources and Climate Change Mitigation [O. Edenhofer, R. Pichs- Madruga, Y. Sokona, K. Seyboth, P. Matschoss, S. Kadner, T. Zwickel, P. Eickemeier, G. Hansen, S. Schlömer, C. von Stechow (eds)], Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA.

- ↑ Created internally by a member of the Energy Education team

- ↑ M. Parkin and R. Bade. Economics: Canada in the Global Environment. Toronto: Pearson, 2013, pp. 140.

- ↑ J.Black, N. Hashimzade, and G. Myles. (2009) "Fiscal Policy." [Online], Available: http://www.oxfordreference.com/view/10.1093/acref/9780199237043.001.0001/acref-9780199237043-e-1214?rskey=Vd7okA&result=1, 2009 [Aug 22, 2016]

- ↑ IEA. World Energy Outlook 2015: Executive Summary. Paris: OECD/IEA, 2015, pp. 6-7.