Emissions trading

Emissions trading is John H. Dales's revolutionary idea of using market forces to reduce pollution by making companies buy and sell the right to pollute.[2] The idea seems to go back to 1968 when the University of Toronto economist proposed paying for the right to pollute,[3] he suggested this would be more effective than simply suing companies that pollute. The Kyoto Protocol (in 1997) argued that emissions trading could be used as a market-based instrument to reduce greenhouse gases (GHG's), carbon dioxide (CO2).[4] The emissions trading system is designed to correct the externality of pollution by making the legal right to emit pollutants a product that must be sold, purchased and traded.

For a contrast see carbon tax vs. emissions trading or the page on carbon taxes.

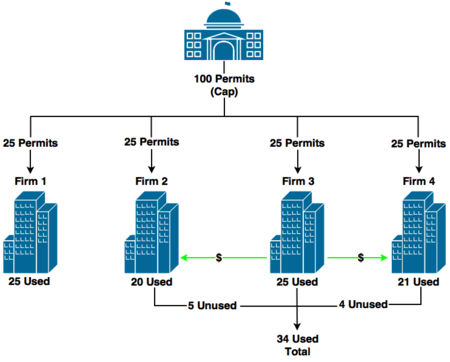

The trading system establishes a maximum allowable amount of pollution, a cap, that can be released. This cap is the total amount of a particular pollutant that can be emitted by everyone in a particular jurisdiction (a province, a state, a country, or even a group of jurisdictions). The cap is divided into permits which are distributed to firms that emit pollutants (mercury, carbon monoxide, NOx, etc.). This permit states that the owner of the permit can emit a certain amount of the given pollutant. If a firm has uses all of its permits, it can try to buy unused permits from other firms. These other firms haven't reached their quota and can continue to pollute or can sell off the right to pollute. Having to purchase extra permits increases the marginal cost of production and so the price to consumers increases as well.[5] In short, this makes production more expensive.

The higher price from purchasing more permits creates an incentive. Specifically, this incentive makes companies want to improve production methods to reduce emissions, because they're now paying. This is the internalization of the externality; the companies are now paying for what they use to get for free (the right to pollute). As long as there is a reasonable cap which allows for sufficient production then the market will stay efficient but if the cap is too small it will suppress supply and create a shortage in the market.

Emission Trading Market

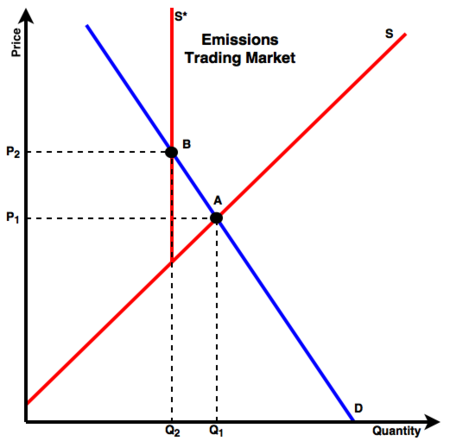

- At Point A the market is in equilibrium, the supply (S) meets the demand (D) and the price (P1) and the quantity (Q1) reflect this equilibrium.

- When a cap is placed on emissions it means there is an absolute upper limit placed on the supply in the market making the supply curve (S*) completely inelastic meaning it does not respond to any change in the price as it usually would.

- The supply curve shifts from S to S*.

- The reduction in supply from Q1 to Q2 means an increase in the price from P1 to P2

In theory an emissions trading system limits the total amount of emissions meaning that there is a limit to the total production. Normally this would create a larger deadweight loss in the market but because firms can trade emission permits amongst themselves the market can allocate the amount of pollution among firms, some who produce more and some who produce less. The more efficient allocation due to the trading shrinks the otherwise large deadweight loss that would be in the market.[7]

For Further Reading

- Carbon tax

- Polluter pays principle

- Externality

- Or explore a random page

References

- ↑ Created internally by a member of the Energy Education team

- ↑ The idea was first put forth in his book 'Pollution, Property & Prices: An Essay in Policy-Making and Economics' by John H. Dales, 1968.

- ↑ See for example: http://www.eenews.net/stories/1059956477 [accessed June 26th, 2016] and http://www.smithsonianmag.com/air/the-political-history-of-cap-and-trade-34711212/?no-ist [accessed June 26th, 2016.]

- ↑ Verbruggen, A., W. Moomaw, J. Nyboer, 2011: Annex I: Glossary, Acronyms, Chemical Symbols and Prefixes. In IPCC Special Report on Renewable Energy Sources and Climate Change Mitigation [O. Edenhofer, R. Pichs- Madruga, Y. Sokona, K. Seyboth, P. Matschoss, S. Kadner, T. Zwickel, P. Eickemeier, G. Hansen, S. Schlömer, C. von Stechow (eds)], Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA.

- ↑ Verbruggen, A., W. Moomaw, J. Nyboer, 2011: Annex I: Glossary, Acronyms, Chemical Symbols and Prefixes. In IPCC Special Report on Renewable Energy Sources and Climate Change Mitigation.

- ↑ Created internally by a member of the Energy Education team

- ↑ Verbruggen, A., W. Moomaw, J. Nyboer, 2011: Annex I: Glossary, Acronyms, Chemical Symbols and Prefixes. In IPCC Special Report on Renewable Energy Sources and Climate Change Mitigation [O. Edenhofer, R. Pichs- Madruga, Y. Sokona, K. Seyboth, P. Matschoss, S. Kadner, T. Zwickel, P. Eickemeier, G. Hansen, S. Schlömer, C. von Stechow (eds)], Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA.