Carbon tax vs emissions trading

There is a debate over which policy is best to moderate the use of fossil fuels and limit carbon emissions and pollution as a result of the combustion of these fuels for electrical generation and other uses. Emissions trading or cap-and-trade (CAT) and a carbon tax are fundamentally different tools to limit the effects of using fossil fuels. Carbon taxes makes emitting carbon dioxide more expensive. No matter how much gets emitted a carbon tax makes the emission the same. Cap-and-Trade systems limit the amount of carbon dioxide that gets emitted, but gives little control to the price. [1][2]

Effects of Emissions Trading and a Carbon Tax

There are positive elements and negative elements to both policies but neither policy is proven to be better than the other and this article does not endorse one policy over the other. Many actual policies attempt to take the benefits of both systems.

Price and Quantity

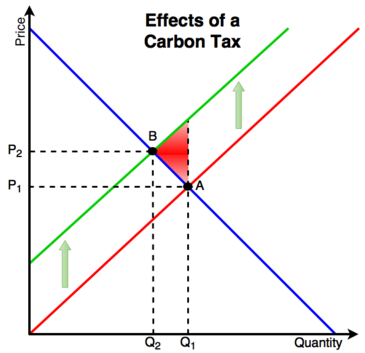

Carbon Tax - The size of a tax on the carbon content of fuels gives a level of certainty to what the final price will be. While the price of fuels are subject to market forces and fluctuate accordingly, the size of the carbon tax is the same over the long run and is simply added on top of whatever the market price is at the time.[5]

If a litre of gasoline costs $0.95 one day and $1.05 the next and there is a $0.05 tax on each litre, the tax is just added to the daily price. In Figure 1. the tax raises the price and reduces the quantity but the market can adjust and fluctuate to accommodate changes in supply and demand, consumers will buy less gasoline with a tax, the size of the tax determines how much less consumers will buy.

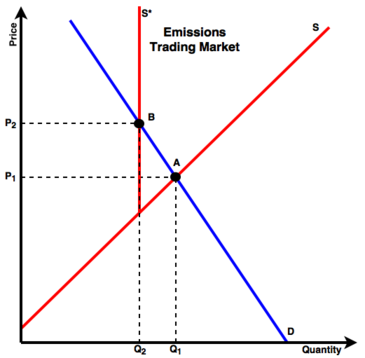

Cap-and-trade - There is a certain amount of unpredictability when estimating the price of carbon credits under a CAT system. Because the total quantity of credits is limited, they must be traded amongst firms if one firm wants to produce more than their original amount of credits allows. As the emission credits become more and more scarce, the price will rise accordingly. The fewer credits there are the more expensive they will be.

The danger of having a limited number of credits is that the price of credits could rise to a very high level and firms will pass the cost onto consumers in the form of higher prices on the final product. Under a CAT system, because the level of credits supplied to the market is fixed, the market cannot adjust to meet higher demand, this comes in the form of higher prices.[6]

In Figure 2. when the supply of credits to the market is reduced from S to S* the quantity falls from Q1 to Q2. The demand increases and the market can only respond with higher prices (P1 to P2).

Since the supply of credits is limited, the amount of emissions is known, the government or agency will decide how many credits to issue depending on the level of emissions they deem acceptable. A CAT system determines the price of emissions because the maximum amount is fixed therefore only the price can vary. But in Figure 2. there is no limit to the rise in price (it does not intercept the Y-axis). In contrast, the carbon tax system determines the quantity produced, under the tax imposed, consumers will decide how much they want to buy or the quantity that will be demanded. Unlike the CAT system the quantity of emissions is unknown, the level of emissions produced depends entirely on the demand of consumers.[7] Consumers can by less or a lot less depending on their willingness to pay the higher price.

Low and No-carbon Alternatives

Under both systems, consumers and firms will be encouraged to find energy alternatives that produce fewer emissions or containing less carbon.

Carbon Tax - Consumers will search for ways to avoid paying the higher price for carbon fuels. A consumer might just simply drive a little less to avoid the higher cost of fuel. Maybe they will buy a hybrid car or electric car to dramatically lower their gasoline consumption and in effect, the amount of money they pay for gasoline. A homeowner could install a ground source heat pump to heat their home instead of a conventional gas furnace. In any one of these scenarios the demand for fuels with a carbon tax on them decreases.

Cap-and-trade - Under this system energy firms, mostly those who use fossil fuels to generate electricity, will search for ways to make the process more efficient and emit fewer emissions.[8] Firms might stop burning lignite coal and instead burn anthracite coal for a more complete combustion. The same firm could also close their coal operation and use combined cycle gas plants instead as they generate substantially fewer emissions. The CAT system would also stimulate investment in no-carbon energy systems such as solar power, wind power, nuclear power etc. Because these generation methods have virtually zero emissions, they would not have to worry about buying and selling permits at all.

The CAT system would force firms to make their activities as low carbon as possible. This has the double benefit of reducing overall emissions and keeping the price of energy low to consumers. Because the firms will lower their emissions they will need fewer credits and therefore the demand for credits will stay lower than if the firms did not reduce emissions. The cost passed onto the consumer will be smaller because the firms will have lower costs than they would have if the demand and price for permits was high.[7]

Other Aspects

There are additional benefits to be reaped from the implementation of either a carbon tax or CAT system other than just a reduction in emissions:

Carbon Tax - The revenue that a carbon tax generates can be used to encourage investment in more renewable energy projects by offering subsidies to companies who build low or no-carbon plants. The revenue could be used to remediate environmental damage caused by carbon emissions and pollution.

The revenue could also be used to reduce the effect of more inefficient taxes in the economy of a country or area. In British Columbia (B.C) for the fiscal year 2013-2014 under the Carbon Tax Act the province raised $1.2 billion and at the same time was able to reduce corporate income taxes by $440 million, personal income tax by $237 million and were able to offer $194 million worth of low-income tax credits.[9] From 2008-2013, the institution of the carbon tax in B.C decreased per capita use of fossil fuels in the province by 16.1%.[10]

Cap-and-trade - Under the CAT system, firms can buy and sell credits that they need or didn't use. Firms will want to reduce their emissions so they can sell as many credits to other firms as possible. The selling of credits to other firms will allow firms to increase their profit.[2]

References

- ↑ Verbruggen, A., W. Moomaw, J. Nyboer, 2011: Annex I: Glossary, Acronyms, Chemical Symbols and Prefixes. In IPCC Special Report on Renewable Energy Sources and Climate Change Mitigation [O. Edenhofer, R. Pichs- Madruga, Y. Sokona, K. Seyboth, P. Matschoss, S. Kadner, T. Zwickel, P. Eickemeier, G. Hansen, S. Schlömer, C. von Stechow (eds)], Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA.

- ↑ 2.0 2.1 A. Goolsbee, S. Levitt and C. Syverson. Microeconomics. New York: Worth Publishers, 2013, pp. 662.

- ↑ Created internally by a member of the Energy Education team

- ↑ Created internally by a member of the Energy Education team

- ↑ M. Homom. Economic Efficiency of Carbon Tax versus Carbon Cap-and-Trade. Homom Consulting & Business Solutions Inc., 2015, pp. 8.

- ↑ A. Goolsbee, S. Levitt and C. Syverson. Microeconomics. New York: Worth Publishers, 2013, pp. 662-664.

- ↑ 7.0 7.1 C. Frank. "Pricing Carbon: A Carbon Tax or Cap-And-Trade?" [Online], Available: https://www.brookings.edu/blog/planetpolicy/2014/08/12/pricing-carbon-a-carbon-tax-or-cap-and-trade/, Aug 12, 2014 [Aug 27, 2016].

- ↑ C. Frank. The Net Benefits of Low and No-carbon Electricity Technologies Firms. The Brookings Institute: Global Economy and Development, May 2014, pp. 3.

- ↑ Pembina Institute. The B.C Carbon Tax Calgary: Pembina Institute for Appropriate Development, 2014, pp. 1.

- ↑ Pembina Institute. The B.C Carbon Tax. pp. 2.