Negative externality

Economists use the term externality to describe any time the price determined by a market doesn't reflect the true cost of an action. A negative externality is a bad consequence that isn't taken into account, like the harm that comes from pollution.

An externality is an effect that an economic transaction has on a party who is not involved in the transaction.[1] Externalities deter a market from producing the equilibrium quantity and price for a good service. Externalities produce inefficiencies in markets and can eventually produce a market failure if not internalized in time.

Negative Externality

A negative externality occurs when an economic transaction imposes a cost to a uninvolved third party. A negative externality occurs when the social cost is greater than the production cost or private cost. This means that there is a total negative effect imposed on society from economic activity.[2]

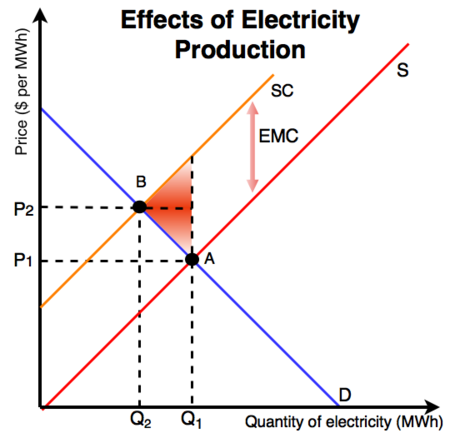

Effects of Electricity Production

- At Point A the producer is generating electricity by burning fossil fuels which release pollutants into the air and adversely affect the environment and the population near the plant. The producer does not take these external effects into account, they only want to meet their own costs, S.

- As a result, P1 and Q1 are the price and quantity produced.

- At Point B the socially optimal price (P2) and quantity (Q2) are met, the higher price and lower quantity reflect the cost to society as a whole, the social marginal cost, SMC.

- The size of the SMC is shown by the arrow and the difference between SC and S.

Externalities from Electricity Production

Fossil fuel energy producers fail to take into account the social cost from the production of energy (most often relating to fossil fuel combustion). The failure to consider the negative effects can increase or prolong the deadweight loss in a market. If the deadweight loss is large enough this can lead to a market failure.

Due to the large amount of pollution from the generation of electricity using fossil fuels such as coal and the negative effects its causes on society as a whole there is a social cost inflicted. The negative effects of this activity can come in many forms, be it:

- The release of large amounts of CO2 which contribute substantially to climate change in a number of ways. Climate change has quite a few costs that are paid by people in general.

- More respiratory illnesses leading to higher medical costs to the state from the pollutants (as opposed to the CO2 release which doesn't tend to directly cause these problems)

- Increased acid rain and its effects on water systems (due to pollutants).

- The release of mercury and its effect on wildlife (both bioaccumulation and biomagnification.

- Or a number of other negative results.

To correct the negative effects of the pollution generated by electrical production, the government can implement a number of policies for example it could levy a tax on pollution and emissions from plants that produce it. A tax would bring P1 up to P2, the socially efficient price. The revenues collected from the tax can be used to subsidize renewable energy initiatives, promote the development of new, low-carbon technologies or increase healthcare spending to cope with increased illness resulting from pollution among other things.

To remediate a failing market, governments attempt to prevent the market from producing inefficient outcomes by affecting the price or quantity creating the externality, thus minimizing the negative effects.[4] Due to firms and consumers do not always take into account the social cost, government policies can be used to incentivize or in some cases force firms and consumers to make decisions that account for the social cost, most often this takes the form of regulations. This can 'protect' the market from failure and help ensure an efficient allocation of goods and services in a market.

See Also

References

- ↑ A. Goolsbee, S. Levitt and C. Syverson. Microeconomics. New York: Worth Publishers, 2013, pp. 645.

- ↑ J.Black, N. Hashimzade, and G. Myles. (2009) "Externality." [Online], Available: http://www.oxfordreference.com/view/10.1093/acref/9780199237043.001.0001/acref-9780199237043-e-1134?rskey=tR8JO1&result=5, 2009 [June 12, 2016]

- ↑ A. Goolsbee, S. Levitt and C. Syverson. Microeconomics, 649.

- ↑ V. Christiansen and S. Smith. "Externality-Correcting Taxes and Regulation". The Scandinavian Journal of Economics, 114(2), pp. 1, 2012.