Pigouvian subsidy

A pigouvian subsidy is a subsidy that is used to encourage behaviour that have positive effects on others who are not involved or society at large.[1] Behaviors or actions that are a benefit to others who are not involved in the transaction are called positive externalities. This is closely related to the idea of a pigouvian tax.

Positive Externality

A positive externality is something that enhances society as a whole. It results from an economic transaction that has positive external effects on others not party to the transaction.

One example of a positive externality is the market for education. The more education a person receives, the greater the social benefit since more educated people tend to be more enterprising, meaning they bring greater economic value to their community.[2]

Another example is behaviour that reduces pollution that imposes a negative effect on society. Assume a government wants to reduce the dependence of their country on fossil fuels, the government might give a subsidy to homeowners who buy solar panels for their house to reduce the amount of electricity they draw from the grid that is powered by coal.[3]

If the government offers a 20% subsidy on residential solar systems and the cost of installing a system of panels that can power the house is $20,000 then the cost to the homeowner will be $16,000. The subsidy both encourages the consumer to buy the cheaper product and encourages the seller to continue producing and selling the product as they still receive the full price of the product. In short, a consumer subsidy increases demand and lowers price for the consumer.

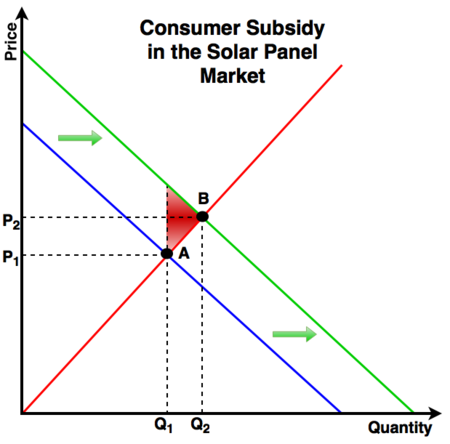

Effect of a Consumer Subsidy on the Market for Solar Panels

- At Point A the market is in equilibrium, the price (P1) is equal to the quantity supplied (Q1).

- When the government introduces a subsidy to the consumers, the demand for the panels increases overall, there is a shift in the demand curve, denoted by the Green Arrows.

- Producers respond to the increased demand with a increased supply ((Q1) to (Q2), the price rises as a response to the increased demand ((P1) to (P2))[5]

- The price to the consumer stays low however as the subsidy negates the normal market forces that would make the consumer pay the higher price..

- The subsidy encourages consumers to buy more solar panels but keeps the price the same for the producer.

- The Red Triangle represents the deadweight loss (DWT) that results form the subsidy, the cost of the subsidy decreases the competitiveness of the market. However, the economic inefficiency is offset by the social benefit of reducing pollution from reliance on fossil fuel electricity generation methods.

References

- ↑ A. Goolsbee, S. Levitt and C. Syverson. Microeconomics. New York: Worth Publishers, 2013, pp. 656.

- ↑ J.Black, N. Hashimzade, and G. Myles. (2009) "Externality." [Online], Available: http://www.oxfordreference.com/view/10.1093/acref/9780199237043.001.0001/acref-9780199237043-e-1134?rskey=tR8JO1&result=5.

- ↑ Verbruggen, A., W. Moomaw, J. Nyboer, 2011: Annex I: Glossary, Acronyms, Chemical Symbols and Prefixes. In IPCC Special Report on Renewable Energy Sources and Climate Change Mitigation [O. Edenhofer, R. Pichs- Madruga, Y. Sokona, K. Seyboth, P. Matschoss, S. Kadner, T. Zwickel, P. Eickemeier, G. Hansen, S. Schlömer, C. von Stechow (eds)], Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA.

- ↑ A. Goolsbee, S. Levitt and C. Syverson. Microeconomics, 649.

- ↑ H. Kohler. Intermediate Microeconomics: Theory and Applications. London: Scott, Foresman and Company, 1990, pp. 562-564.