Monopoly: Difference between revisions

No edit summary |

m (1 revision imported) |

||

| (2 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

[[Category:Done | [[Category:Done 2018-06-15]] | ||

<onlyinclude>A firm that is the only supplier or seller in a [[market]] is said to have a monopoly. | <onlyinclude>A firm that is the only supplier or seller in a [[market]] is said to have a monopoly. A lack of competition allows the firm to charge a much higher [[price]] for [[goods and services]], thus generating more revenue.</onlyinclude><ref>J.Black, N. Hashimzade, and G. Myles. (2009) "Monopoly." [Online], Available: http://www.oxfordreference.com/view/10.1093/acref/9780199237043.001.0001/acref-9780199237043-e-2026?rskey=eK2AMW&result=1 , 2009 [May 27, 2016]</ref> In a monopolistic setting, the single seller is able to set the price because they do not have to compete with firms offering lower prices. A firm that is able to change the price of the good or service it sells has [[market power]].<ref>A. Goolsbee, S. Levitt and C. Syverson. ‘’Microeconomics’’. New York: Worth Publishers, 2013, pp. 348.</ref> In this sense, price becomes a function of output. In a perfectly competitive market, sellers are instead '''[[price taker]]s''' meaning they are unable to charge the price for a good or service that they desire. | ||

For example, imagine a consumer goes to purchase [[gasoline]] for their [[motor vehicle|vehicle]] and there is only one firm that owns all the [[gasoline station]]s in the city. The price of gasoline is closely linked to the price of [[oil]], which is a component of gasoline, thus as the price of oil falls, the price of gasoline typically will fall. The monopolistic firm has the ability to control the price as they desire, due to the market power they possess. This allows them to artificially raise the price, even when the price of inputs such as oil, may fall. | |||

==Monopolistic Effect on a Market== | ==Monopolistic Effect on a Market== | ||

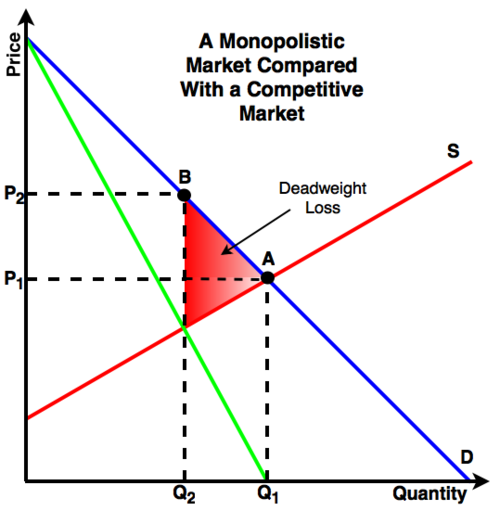

[[File:Monopoly- Graph v.2.png|500px|thumb|right|Figure 1. Monopolies disrupt the equilibrium when the competition is disrupted, '''Point A → Point B'''. There is less of the good (like gasoline) and it is more expensive (people are paying more at the gas station). Both the consumer and producer experience some inefficiency. The portion of the red triangle above the dotted line is the amount of inefficiency the consumers experience. The portion below is the amount of inefficiency experienced by the producer.<ref>Created internally by a member of the Energy Education team.</ref>]] | [[File:Monopoly- Graph v.2.png|500px|thumb|right|Figure 1. Monopolies disrupt the equilibrium when the competition is disrupted, '''Point A → Point B'''. There is less of the good (like gasoline) and it is more expensive (people are paying more at the gas station). Both the consumer and producer experience some inefficiency. The portion of the red triangle above the dotted line is the amount of inefficiency the consumers experience. The portion below is the amount of inefficiency experienced by the producer.<ref>Created internally by a member of the Energy Education team.</ref>]] | ||

Monopolies create | Monopolies create inefficiencies because there is no competition to ensure a "fair" price and quantity. The market becomes inefficient as the good or service is both more expensive and less available. | ||

'''Figure 1''' shows what this looks like graphically: | '''Figure 1''' shows what this looks like graphically: | ||

*At '''Point A''' the market is at [[equilibrium]], | *At '''Point A''' the market is at competitive [[equilibrium]], and the supply ('''S''') meets the demand ('''D'''). Both the price ('''P<sub>C</sub>''') and the quantity ('''Q<sub>C</sub>''') reflect this equilibrium. | ||

*At '''Point B''' there is a monopolistic | *At '''Point B''' there is a monopolistic equilibrium, where one seller controls the market. The seller is able to both restrict the quantity available '''Q<sub>M</sub>''' from and raise the price '''P<sub>M</sub>'''. | ||

*The inefficiency in the market as a result of a monopoly is represented by the '''red triangle''' in '''Figure 1'''. Because the equilibrium is disrupted, both consumers and the producer suffer. This is called [[deadweight loss]] and occurs in a monopolistic market as a result of the restricted supply. | *The inefficiency in the market as a result of a monopoly is represented by the '''red triangle''' in '''Figure 1'''. Because the equilibrium is disrupted, both consumers and the producer suffer. This is called [[deadweight loss]] and occurs in a monopolistic market as a result of the restricted supply. | ||

In this scenario, some people who want the good are not able to get it. Those who are able to get the good have to pay a higher price. If this is not corrected | In this scenario, some people who want the good are not able to get it. Those who are able to get the good have to pay a higher price, and thus are classified as having a higher willingness to pay. If this is not corrected or regulated, it could lead to a [[market failure]]. | ||

Depending on | Depending on the type of good the market is selling, there are varying degrees of complications that may arise from market inefficiency. If it is a ''luxury good'' such as a sports car or a handbag, the effects are relatively minor. The monopolistic market may be inefficient, but there will not be a large [[social cost]]. Conversely, if the good is deemed to be an ''essential good'' (like gasoline, or the ability to [[home temperature control|heat a home]]), the effect of an inefficient market can be devastating. | ||

==Why Efficiency is Important== | ==Why Efficiency is Important== | ||

When the market for essential goods, such as food or [[electricity]], is inefficient, there can be negative social implications. If prices for these essential goods are so high that the [[world population|population]] cannot afford it, there is a negative [[social cost]]. | |||

Today, in many places electricity can be considered an [[essential good]], or a [[need]]. In a society with a geographic position that experiences a cold winter or season, being unable to afford electricity can lead to a consumer having to make a decision that could be harmful. If a home in a developing nation was powered by a modular electric [[heater]] and the price of electricity rises so high that it is unaffordable the household will have to find an alternative. Perhaps the household decided to burn wood because the cost of a natural gas [[heater]] is too expensive. The burning of wood for heat or [[charcoal]] for cooking means that the people of the house hold will be exposed to harmful effects from the [[smoke]] emitted. The use of wood, charcoal and other [[Access to non-solid fuel|solid fuels]] increases the instances of pneumonia, stroke, heart disease, and lung cancer.<ref>The World Health Organization. (May 7, 2015). ''Household Air Pollution'' [Online]. Available: http://www.who.int/mediacentre/factsheets/fs292/en/ Overall, the World Health Organization estimates that there are 4 million deaths per year that are partially caused by the use of solid fuels, including charcoal.</ref> The increased instances of these ailments can burden a healthcare system and make that system inefficient as a result. While inefficient markets are not inherently a bad thing and in some situations can be a positive outcome, there are scenarios where inefficient markets can have drastic effects and impose a large social cost. | Today, in many places electricity can be considered an [[essential good]], or a [[need]]. In a society with a geographic position that experiences a cold winter or season, being unable to afford electricity can lead to a consumer having to make a decision that could be harmful. If a home in a developing nation was powered by a modular electric [[heater]] and the price of electricity rises so high that it is unaffordable the household will have to find an alternative. Perhaps the household decided to burn wood because the cost of a natural gas [[heater]] is too expensive. The burning of wood for heat or [[charcoal]] for cooking means that the people of the house hold will be exposed to harmful effects from the [[smoke]] emitted. The use of wood, charcoal and other [[Access to non-solid fuel|solid fuels]] increases the instances of pneumonia, stroke, heart disease, and lung cancer.<ref>The World Health Organization. (May 7, 2015). ''Household Air Pollution'' [Online]. Available: http://www.who.int/mediacentre/factsheets/fs292/en/ Overall, the World Health Organization estimates that there are 4 million deaths per year that are partially caused by the use of solid fuels, including charcoal.</ref> The increased instances of these ailments can burden a healthcare system and make that system inefficient as a result. While inefficient markets are not inherently a bad thing and in some situations can be a positive outcome, there are scenarios where inefficient markets can have drastic effects and impose a large social cost. | ||

==Natural Monopoly== | ==Natural Monopoly== | ||

A '''natural monopoly''' emerges when it is more efficient for one firm to produce a good or service than multiple firms.<ref>The Economist. "Natural Monopoly." [Online], Available: http://www.economist.com/economics-a-to-z/n#node-21529735 [May 27, 2016].</ref> Common examples of | A '''natural monopoly''' emerges when it is more efficient for one firm to produce a good or service than if multiple firms were present.<ref>The Economist. "Natural Monopoly." [Online], Available: http://www.economist.com/economics-a-to-z/n#node-21529735 [May 27, 2016].</ref> Common examples of markets with natural monopolies include [[water]] and [[electricity]] distribution within a municipality. The cost of building the infrastructure for both water and electricity distribution is very expensive, thus, it is more efficient for one firm to supply the market. Natural monopolies emerge as a result of the [[economies of scale]] available in the market, meaning it is easier for a larger firm to produce at a lower cost than it is for smaller firms to do so.<ref>C. Decker. ''Modern Economic Regulation.'' Cambridge: Cambridge University Press, 2015, pp. 18.</ref> | ||

Suppose three firms | Suppose three firms (one small, one medium and one large), were competing in the market for the distribution of electricity in a city. The large firm builds its infrastructure throughout the city and offers electricity at a low rate to consumers. The medium sized firm also builds its infrastructure alongside that of the larger firm but because of the smaller size of the firm it has to charge higher prices to recoup the cost of the infrastructure. The small firm decides not to enter the market because the required infrastructure is too expensive for them to build and their rates would be far too high, making them uncompetitive in the market. In this case, the high cost that prevented the small firm form entering the market is called a '''[[barrier to entry]]'''. Eventually the medium sized firm will fall out of the market due to the nature of the market where the lowest price prevails. Because the other two firms left (or didn't enter) the market "naturally", the larger firm is left as the sole producer and therefore it is a natural monopoly. | ||

==Is There a More Efficient Way?== | ==Is There a More Efficient Way?== | ||

There are some criticisms of natural monopolies | There are some criticisms of natural monopolies' levels of efficiency. The most prominent argument against monopolies efficiency stems from the lack of competition. This lack of competition allows monopolies to operate at higher [[fixed cost | cost]]. If there was competition, the firm would be forced to minimize costs to present the most competitive price to consumers. There are three main sources for these inefficiencies:<ref>C. Decker. ''Modern Economic Regulation.'' pp. 25.</ref> | ||

#'''Technology'''- A monopolistic firm will be less likely to | #'''Technology'''- A monopolistic firm will be less likely to improve technology to [[Pareto efficiency | optimize]] production and become more efficient because they do not have to compete with firms that do have more efficient schemes. | ||

#'''Management'''- A monopolistic firm has a management scheme that is less likely to seek efficient solutions to problems and is less likely to take risks. This is simply because they do not have to. A competitive firm has to do both of those things in order to get an edge on its other competitors in the market. | #'''Management'''- A monopolistic firm has a management scheme that is less likely to seek efficient solutions to problems and is less likely to take risks. This is simply because they do not have to. A competitive firm has to do both of those things in order to get an edge on its other competitors in the market. | ||

#'''Innovation'''- | #'''Innovation'''- The overarching reason for the inefficiency of a monopoly is because a monopolistic firm has less motivation to innovate. Because there is no incentive to maximize (i.e. the need to stay ahead of other firms), a monopoly is less likely to invest in new technologies, production methods, management teams and other factors. | ||

==For Further Reading== | |||

*[[Oligopoly]] | |||

*[[Monopsony]] | |||

*[[Oligopsony]] | |||

*[[Free market]] | |||

*Or explore a [[Special:Random|random page]] | |||

==References== | ==References== | ||

{{reflist}} | {{reflist}} | ||

[[Category: Uploaded]] | |||

Latest revision as of 14:30, 25 June 2018

A firm that is the only supplier or seller in a market is said to have a monopoly. A lack of competition allows the firm to charge a much higher price for goods and services, thus generating more revenue.[1] In a monopolistic setting, the single seller is able to set the price because they do not have to compete with firms offering lower prices. A firm that is able to change the price of the good or service it sells has market power.[2] In this sense, price becomes a function of output. In a perfectly competitive market, sellers are instead price takers meaning they are unable to charge the price for a good or service that they desire.

For example, imagine a consumer goes to purchase gasoline for their vehicle and there is only one firm that owns all the gasoline stations in the city. The price of gasoline is closely linked to the price of oil, which is a component of gasoline, thus as the price of oil falls, the price of gasoline typically will fall. The monopolistic firm has the ability to control the price as they desire, due to the market power they possess. This allows them to artificially raise the price, even when the price of inputs such as oil, may fall.

Monopolistic Effect on a Market

Monopolies create inefficiencies because there is no competition to ensure a "fair" price and quantity. The market becomes inefficient as the good or service is both more expensive and less available. Figure 1 shows what this looks like graphically:

- At Point A the market is at competitive equilibrium, and the supply (S) meets the demand (D). Both the price (PC) and the quantity (QC) reflect this equilibrium.

- At Point B there is a monopolistic equilibrium, where one seller controls the market. The seller is able to both restrict the quantity available QM from and raise the price PM.

- The inefficiency in the market as a result of a monopoly is represented by the red triangle in Figure 1. Because the equilibrium is disrupted, both consumers and the producer suffer. This is called deadweight loss and occurs in a monopolistic market as a result of the restricted supply.

In this scenario, some people who want the good are not able to get it. Those who are able to get the good have to pay a higher price, and thus are classified as having a higher willingness to pay. If this is not corrected or regulated, it could lead to a market failure.

Depending on the type of good the market is selling, there are varying degrees of complications that may arise from market inefficiency. If it is a luxury good such as a sports car or a handbag, the effects are relatively minor. The monopolistic market may be inefficient, but there will not be a large social cost. Conversely, if the good is deemed to be an essential good (like gasoline, or the ability to heat a home), the effect of an inefficient market can be devastating.

Why Efficiency is Important

When the market for essential goods, such as food or electricity, is inefficient, there can be negative social implications. If prices for these essential goods are so high that the population cannot afford it, there is a negative social cost.

Today, in many places electricity can be considered an essential good, or a need. In a society with a geographic position that experiences a cold winter or season, being unable to afford electricity can lead to a consumer having to make a decision that could be harmful. If a home in a developing nation was powered by a modular electric heater and the price of electricity rises so high that it is unaffordable the household will have to find an alternative. Perhaps the household decided to burn wood because the cost of a natural gas heater is too expensive. The burning of wood for heat or charcoal for cooking means that the people of the house hold will be exposed to harmful effects from the smoke emitted. The use of wood, charcoal and other solid fuels increases the instances of pneumonia, stroke, heart disease, and lung cancer.[4] The increased instances of these ailments can burden a healthcare system and make that system inefficient as a result. While inefficient markets are not inherently a bad thing and in some situations can be a positive outcome, there are scenarios where inefficient markets can have drastic effects and impose a large social cost.

Natural Monopoly

A natural monopoly emerges when it is more efficient for one firm to produce a good or service than if multiple firms were present.[5] Common examples of markets with natural monopolies include water and electricity distribution within a municipality. The cost of building the infrastructure for both water and electricity distribution is very expensive, thus, it is more efficient for one firm to supply the market. Natural monopolies emerge as a result of the economies of scale available in the market, meaning it is easier for a larger firm to produce at a lower cost than it is for smaller firms to do so.[6]

Suppose three firms (one small, one medium and one large), were competing in the market for the distribution of electricity in a city. The large firm builds its infrastructure throughout the city and offers electricity at a low rate to consumers. The medium sized firm also builds its infrastructure alongside that of the larger firm but because of the smaller size of the firm it has to charge higher prices to recoup the cost of the infrastructure. The small firm decides not to enter the market because the required infrastructure is too expensive for them to build and their rates would be far too high, making them uncompetitive in the market. In this case, the high cost that prevented the small firm form entering the market is called a barrier to entry. Eventually the medium sized firm will fall out of the market due to the nature of the market where the lowest price prevails. Because the other two firms left (or didn't enter) the market "naturally", the larger firm is left as the sole producer and therefore it is a natural monopoly.

Is There a More Efficient Way?

There are some criticisms of natural monopolies' levels of efficiency. The most prominent argument against monopolies efficiency stems from the lack of competition. This lack of competition allows monopolies to operate at higher cost. If there was competition, the firm would be forced to minimize costs to present the most competitive price to consumers. There are three main sources for these inefficiencies:[7]

- Technology- A monopolistic firm will be less likely to improve technology to optimize production and become more efficient because they do not have to compete with firms that do have more efficient schemes.

- Management- A monopolistic firm has a management scheme that is less likely to seek efficient solutions to problems and is less likely to take risks. This is simply because they do not have to. A competitive firm has to do both of those things in order to get an edge on its other competitors in the market.

- Innovation- The overarching reason for the inefficiency of a monopoly is because a monopolistic firm has less motivation to innovate. Because there is no incentive to maximize (i.e. the need to stay ahead of other firms), a monopoly is less likely to invest in new technologies, production methods, management teams and other factors.

For Further Reading

- Oligopoly

- Monopsony

- Oligopsony

- Free market

- Or explore a random page

References

- ↑ J.Black, N. Hashimzade, and G. Myles. (2009) "Monopoly." [Online], Available: http://www.oxfordreference.com/view/10.1093/acref/9780199237043.001.0001/acref-9780199237043-e-2026?rskey=eK2AMW&result=1 , 2009 [May 27, 2016]

- ↑ A. Goolsbee, S. Levitt and C. Syverson. ‘’Microeconomics’’. New York: Worth Publishers, 2013, pp. 348.

- ↑ Created internally by a member of the Energy Education team.

- ↑ The World Health Organization. (May 7, 2015). Household Air Pollution [Online]. Available: http://www.who.int/mediacentre/factsheets/fs292/en/ Overall, the World Health Organization estimates that there are 4 million deaths per year that are partially caused by the use of solid fuels, including charcoal.

- ↑ The Economist. "Natural Monopoly." [Online], Available: http://www.economist.com/economics-a-to-z/n#node-21529735 [May 27, 2016].

- ↑ C. Decker. Modern Economic Regulation. Cambridge: Cambridge University Press, 2015, pp. 18.

- ↑ C. Decker. Modern Economic Regulation. pp. 25.