Free market

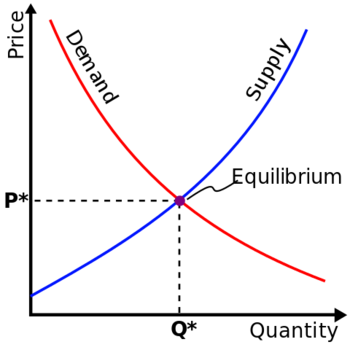

A market is where buyers and sellers exchange goods and services. This market can be physical or virtual and is usually defined by the whatever is exchanged;[2] for example petroleum is exchanged on the oil market. Usually, markets are good for society because these transactions allow people to get the goods and services that they want. These goods and services are exchanged for currency, information, or just other goods and services. Anything that someone values can be exchanged in a market, but today usually a buyer is paying money for a seller else to provide something. The way that buyers and sellers interact in the market determines the how much will be provided (the supply) and how badly these goods and services are wanted (the demand). The interaction between supply and demand of the goods and services will determine the market value (the price) and quality amount that will be sold.

A market economy (also known as a free market) is one that is unburdened by regulation and the economy is therefore subject to the supply and demand market forces. The free market is an abstract idealization first proposed by Adam Smith in his work, The Wealth of Nations. This model is driven by supply and demand where there is perfect competition meaning buyers and sellers may transact as they please without taxation and other government regulations at an equilibrium.[3] Like any model, a free market is a simplification of markets in the real world.

Market economies are not ‘perfect’. With no government regulation, market structures emerge and change the way a market operates. In other words, market economies interact with themselves to create situations that make themselves inefficient! monopolies, oligopolies, monopsonies or oligopsonies may form which distort prices by restricting supply or demand.[4] The under-supply and imperfect price standardization in a market creates a deadweight loss in the economy which creates inefficiencies and have a net negative effect.[5]. Free markets are inherently prone to an unequal distribution of wealth in the economy, this is often measured using the Gini coefficient.[6]

More importantly, no price ever reflects the true cost for a transaction. This difference between the money exchanged in a market and the total consequences for making this transaction are called externalities. Externalities are effects experienced by third parties as a result of economic activity.[7] Market economies produce externalities. These effects can be either negative such as pollution from burning coal for electricity or positive such as the implementation of higher safety regulations at nuclear power plants. A negative externality occurs when the social cost is not considered when looking at the production cost or private cost. This means that society suffers from negative effects from the economic activity (like air pollution from a coal fired power plant). A positive externality occurs when the benefits to society aren't taken into account in the private cost. This creates a potential gain in welfare or an increase in social good.[7] There are ways in which a free market can compensate for negative externalities created by its unregulated activities without government intervention or the implementation of regulation. One such way is the Coase theorem which suggest that if one desires to correct a negative effect they experience, they can create incentives for the party creating the effect. This creates a situation in which a firm will want to fix the problems.

References

- ↑ Wikimedia Commons. (May 14, 20156). Market Curves [Online]. Available: https://commons.wikimedia.org/wiki/File:Supply-demand-equilibrium.svg

- ↑ D. Rutherford. ‘’Routlege Dictionary of Economics’’. London: Routlege, 1995, pp. 286.

- ↑ J.Black, N. Hashimzade, and G. Myles. (2009) ‘’A Dictionary of Economics’’, 3rd ed. [Online], Available: http://www.oxfordreference.com/view/10.1093/acref/9780199237043.001.0001/acref-9780199237043-e-1283?rskey=RlGbO9&result=1

- ↑ A. B. Abel, et al. Macroeconomics, 6th ed. Toronto, Canada: Pearson, 2011, pp. 216.

- ↑ A. Goolsbee, S. Levitt and C. Syverson. ‘’Microeconomics’’. New York: Worth Publishers, 2013, pp. 373-374

- ↑ P. A. Rogerson. "Gini Coefficient of Inequality: A New Interpretation". Letters in Spatial and Resource Sciences, 6. pp 109, August, 2013.

- ↑ 7.0 7.1 A. Goolsbee, S. Levitt and C. Syverson. ‘’Microeconomics’’. New York: Worth Publishers, 2013, pp. 645.